Cloud based – paperless

Single patient interfacing with multiple providers

Pricing based on capacity / availability / value / reputation

Online real time transaction and immediate payment

This is how the service might look

A patient needs to have medical treatment or services. He or she goes online for a virtual consultation, medical information is shared, in real time where possible, assisted by a broker if necessary; Providers of medical services respond with potential offers of rendering care; Pricing, place, and time offers are given; Financing, legal services, and a limited medical liability insurance attached specifically to this service are provided. The decision to move forward is completed. Both parties enter into an agreement.

An example: Mrs. Smith, a 41 year old female living in Santa Monica, California is interested in her yearly diagnostic mammogram. She has heard about the latest in 3D tomosynthesis mammograms. She conveys a short medical history online; if necessary supported by virtual examination; her price range, the timing of the procedure, her willingness to travel, are included in her request. Shortly thereafter, 4 diagnostic radiology centers, including one major University Medical Center, located within 5 miles respond. An appointment is available at 4 PM, the next day at the nearby ABC Radiology Center. An exact price including the professional component by Dr. Jones is exactly $100.00. The patient decides to move forward with this service online, agreeing to certain financial and legal terms Third party financing, if necessary, is offered. Her result is available on a cloud based secure platform within 24 hours of the study.

She gets online to report the value of her experience. She tells all of her friends about Sutureself MD

Payment of the service is immediate. Pricing is transparent. Broker's fees, finance fees, and the fee for the medical malpractice liability insurance policy attached to this service are included.

The (problem) Ailment:

Healthcare expenditures in the United States represents 15% of the GNP, an estimated 2.5 – 2.9 Trillion dollars, and are responsible for as much as 50% to 60 % of individual bankruptcies. The problem is bankrupting Americans. Currently, adequate systems are not in place to allow free market forces to control pricing and shape the quality of healthcare in the United States. Patients do not know the cost of their medical fees before engaging in services. 1.,2.,3,and there is no mechanism in place to “effectively” seek comparative pricing and /or negotiate costs as individuals or collectively through the services of a healthcare broker / specialist, particularly online.

Out of Pocket Expenses

Most insured patients need to have a better way to shop for the first few thousand dollars of health care in the fiscal year. Uninsured patients and those insured patients seeking services that are not covered by their healthcare policies need a better mechanism to seek pricing and value in their healthcare choices.

The Partial Cure:

Currently there are very few user-friendly options for patients to use free market forces to pursue quality and cost effective healthcare. The use of online resources, using virtual consultation as a means to making initial decisions regarding the cost and value of care does not currently exist, at least in any sophisticated form. It is the contention of this author that an interactive online software platform could exist that would allow negotiation and bidding for medical services. The system would increase the transparency of pricing. The technology for this service already exists in other business sectors. This service would drive prices down, increase quality and value for the consumer and the provider, and begin a trend that would begin to improve the healthcare industry for many individuals.

Currently there are government plans for healthcare insurance exchanges that will be available in the near future, with enrollments available possibly as early as October 1st, 2013. Theses exchanges promise that consumers will have an improved ability to choose between health insurance policies. There is no mention anywhere of the creation of exchanges that will allow consumers to have an improved ability to choose their healthcare services directly - i.e. to go outside government or insurance carriers to compare prices, value, and pay for their services directly. Not in conflict with, but in supplement to the best operating systems available, there is a need for healthcare exchanges for patients to seek medical care outside of “covered” services, for out of pocket expenses.

Assuming any reasonable degree of compliance with the goal of insuring all Americans, the dire need, particularly for the young and the healthy, and those who are “minimally ill”, is to be able to shop for affordable Healthcare, that which falls within the deductible and non-covered expenses.

The timing, technology, marketplace, demand, interest, need, and motivation are already in place to allow for the type of consumer driven medical economics described in this essay.

Disruptive change in the healthcare industry

SutureSelf MD will bring costs down and improve access to healthcare for those individuals who seek treatment for out of pocket expenses i.e. outside their insurance coverage, below their deductibles, and for items-excluded from their plans.

New Twist on medical malpractice liability insurance

Embedding the medical liability insurance fee into the transaction cost of a medical service rather than having the liability covered in a traditional manner from a policy purchased by the healthcare provider would be a disruptive departure from the existing system of providing malpractice insurance. In the traditional system, providers purchase medical malpractice insurance to cover all of their acts in a given year or career. Having a per procedure liability policy attached to the cost of a given transaction would be similar to a “travelers or trip” insurance policy for each service. The latter might allow for healthcare providers to order tests or participate in treatments with less concern over malpractice repercussions knowing that this rider type policy would be attached to each treatment. A patient who undergoes care through this new business model agrees to pursue remedies from wrong doing from the medical malpractice policy attached to a given service before attempting to recover any losses from the provider's malpractice policy in the event he or she finds serious fault with her care.

This concept would leapfrog current failed efforts at tort reform as it might allow healthcare providers to pay less for their personal liability policies, and would not be an objection to trial lawyers as there would continue to be monetary awards for medical malpractice.

Business Feasibility Research

Given the massive framework of uncertainty in a project of this scope3.5, a number of feasibility questions would need to be addressed in considering this business model.

In order to acquire more information on this subject, invited guests with expertise in different areas of specialty will be interviewed or invited to comment on the questions and concerns presented.

A thesis of this nature will ask more questions and offer fewer answers. Using a Wikipedia or book building model, created by the contributors, a substantial resource can be created to give shape and definition to the solution.

Where possible, I have made my best guess and entered my response in blue. I invite interpretations and answers from individuals or groups whose expert opinions may differ or be in opposition.

The size of the American Healthcare Industry

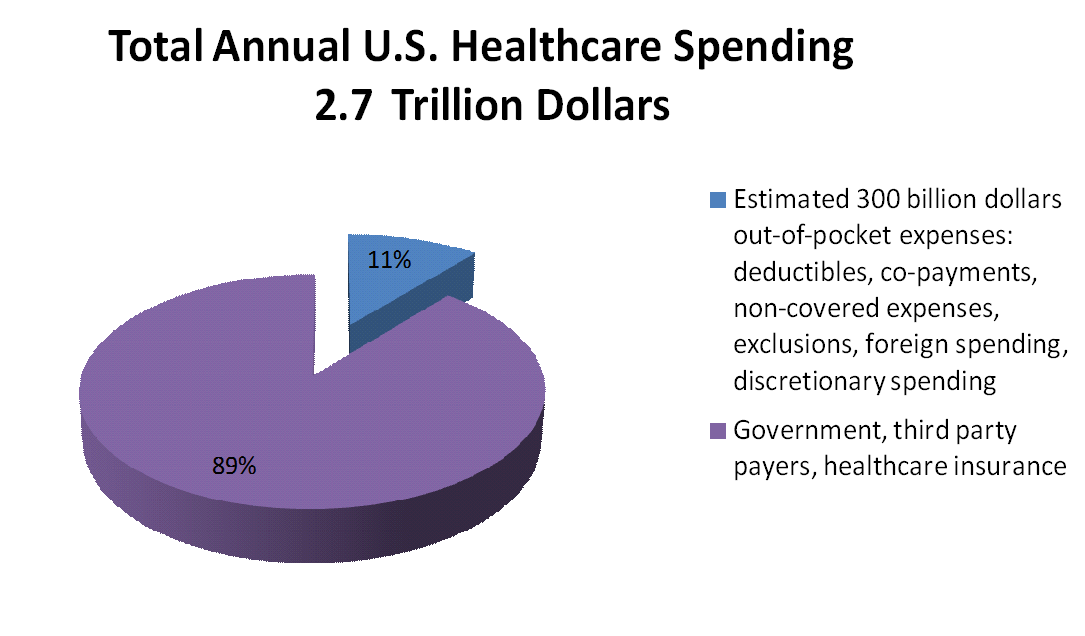

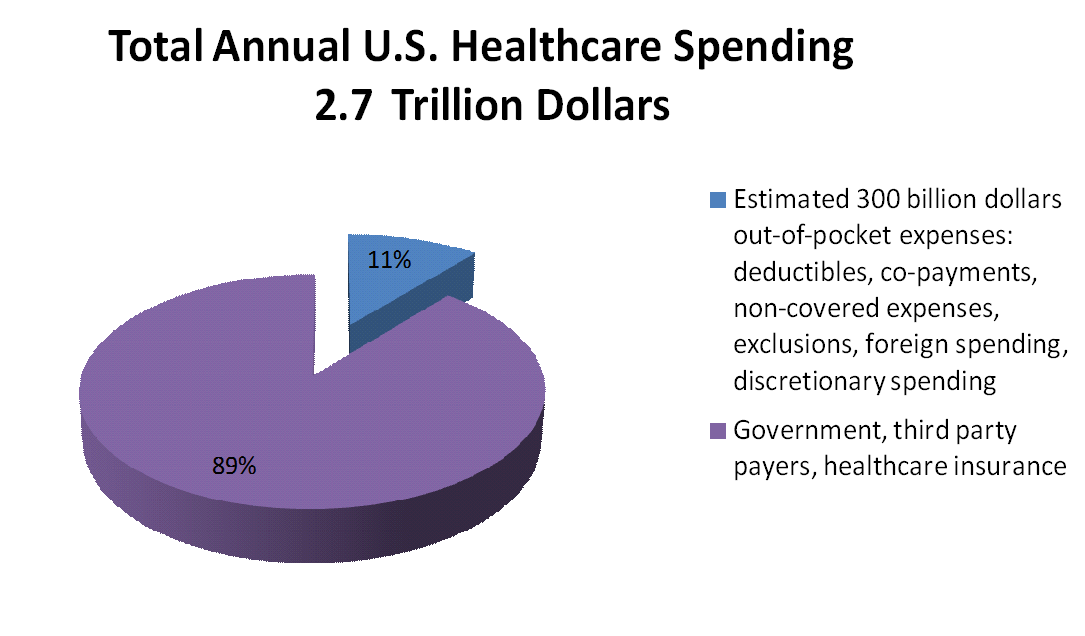

In dollars spent, how big is the healthcare industry in the United States? 2.7 Trillion or 16% of the annual GDP.

What percent of that number reflects money spent by individuals that is outside of coverage by health insurance, government Medicare / Medicaid, and other sources such as foreign spending?

Regarding individuals and groups covered by health insurance – How much money is spent on healthcare costs that fall under the deductibles, co payments, non-covered services, excluded services, denied benefits, and elective services? Non-covered or excluded services, for example, might be coverage of a pregnancy in a policyholder without maternity benefits. Non-covered or excluded services might be, for example, breast surgery on a patient excluded because of the presence of breast implants. Other excluded services might be individual seeking studies that are excluded or not covered such as cosmetic surgery, dental surgery, holistic treatment, chiropractic treatment, those services deemed experimental in cancer treatment, spinal injury, treatment of dementia, etc.

More recently government mandates are allowing coverage of mental health and pre-existing conditions in healthcare insurance policies. However, this doesn’t address out of pocket expenses in many cases.

How big is that number? How big is the foreign health care market that comes to the United States for medical care? Can this business model work in other countries? What will that number be predictably after Obama-care laws are in effect and fully operational? What will be the deductibles in most insurance plans after Obama care insurance exchanges go into effect? My (Donald Altman) guess, which is probably a conservative estimate, is that there may be as much as 250 to 300 billion dollars per year of medical services falling into this category. The slice of pie depicted below represents the portion of medical expenses being described, discretionary income being spent on medical services.

Figure 2

It would be interesting to have the opinions of health care economists as to the true size of this slice in healthcare dollars. How wills this number change in the future?

A note about Deductibles

Obama care rules say deductible plus out-of-pocket costs cannot exceed $6,350 for an individual and $12,700 for a family. Plans to enforce deductibles have recently been delayed.

May 29th, 2013 “Reining in Luxury Health Plans” by Reed Abelson, The New York Times. - This article is about the Cadillac Tax, which is scheduled to take effect in 2018. “Employers who spend more than $10,200.00 on an individual will be charged a 40% tax on the amount exceeding the threshold.”

Employers’ efforts to offer less expensive plans and therefore avoid a Cadillac Tax will be more likely to sponsor health plans with less benefits and higher deductibles. This tax, if put into effect, increases the percent of healthcare dollars spent that will fall into the category of discretionary spending which is the subject matter of this paper.

In the news: Covered California / Mandatory Insurance Purchasing for companies under 50 employees - recently delayed. The Obama administration announced on July 2, 2013 that employers would not be required to provide insurance to their employees for one year, until Jan. 1, 2015. Limiting deductibles has also recently delayed. Employers may have incentives to keep deductibles higher and healthcare expenses lower, Cadillac Tax.

Many PPO plans with high deductibles also tend to offer terms, which require their clients to assume with sizable co payments.

In the News, October 8th, 2013, thirty-six percent of Walgreens employees are under 30 and may want a high-deductible plan with a low monthly premium. Discussion on Aon Hewitt - private health care exchanges. 10

Liability insurance in the healthcare industry

How much money do all healthcare practitioners and providers spend annually in the United States to account for all medical liability insurance expenditure?

Has anyone ever described or studied what percent of healthcare dollars spent on a procedure-to-procedure case basis could be attributed to liability coverage? For example, on a mammogram that costs $100.00, what is the average cost of all liability coverage for all providers involved for that single point of service examination? That number would include a cumulative figure of all providers. In this case it would be the cumulative allotted money set aside from the professional component (physician), the facility component, and possibly the manufactures of the mammography equipment. I estimate that the cost is roughly 5% of the cost of the service. Is this number too high or too low?

In a more complicated situation assume that a patient undergoes an outpatient surgical procedure at a private hospital. What are the cumulative costs of all liability fees paid where the total costs of these fees are inclusive of those for the surgeon, anesthesiologist, pathologist, hospital, radiologist, internist, and pharmacist? Is there a ratio, i.e. a number placed in the numerator (all malpractice fees / divided by the comprehensive cost of all the related services for that individual’s care? For example a total fee for all service charges in a straightforward surgical hospitalization is $50,000.00, what would the cumulative malpractice liability of fees of all the providers be who rendered care for that patient? Again, I estimate that the cost of all liability coverage is about 5%, which in this case would be about $2500. This number might vary from state to state given MICRA laws that are in place.

Who would be the best individuals, organizations or groups to determine that number?

Currently, all providers of medical services carry independent medical malpractice liability coverage. In what might be determined to be a radical departure from the traditional system, would it be feasible to have the fee for the medical malpractice liability coverage embedded within the total transactional fee, i.e. as part of the overall charge for the service rather than by the provider? Why or why not? Phrased differently, let’s say a patient undergoes a mammogram for $100.00, could a certain percentage number be placed as a surcharge that would allow for an independent insurance carrier to provide liability coverage for the case, assigning this liability coverage by contract to the patient, before a litigant could access other coverage? How about $100.00 plus 5% or a total of $105.00. Is this fee too high, too low? What experts are in a position to address this topic?

One might seek comment from experts in the medical malpractice actuarial industry who set prices on malpractice premiums of physicians. Trip insurance policies are calculated very quickly at the time of making reservations; more insight into the nature of this industry is needed. Insight from health care actuary services would be helpful. I would envision the rider to be a smaller policy, say $100,000.00 with a $5000.00 deductible, good for 3 to 5 years from the time of service. (much less expensive that a policy of $1,000,000 / $3,000,000 typically in place in perpetuity)

What government laws allow in the healthcare industry regarding online services

There are numerous legal and regulatory issues that currently shape healthcare in the United States. Could a new system coexist with existing healthcare regulation that would allow for change?

What would be the obstacles to having patients communicate online to physicians or providers regarding sensitive medical information? Regarding HIPAA privacy laws, how much information does the individual have the right to disclose? How much information can a provider discuss in a virtual online environment given that there is adequate consent on behalf of all parties involved?

Could information be stored in a virtual cloud that is HIPAA compliant, such that medical written medical records would not be required? Could a patient have access to his or her own medical records such that they could be shared at his or her discretion?

Is it legal to perform a virtual medical consultation online? Across state lines? Does an examination online fulfill the requirement of an examination by most state medical boards? Has this issue been tested in court?

A number of web-based businesses have begun to appear that suggest exchange of photo information between doctor and patient can be performed in a HIPAA compliant manner. Telecommunications have been used for many years treating individuals at a distance from the providers; prison systems; ambulance triage services to name a few.

On Monday, September 2nd, 2013; NBC Nightly News in Los Angeles California8 reported: - A hospital based robot allows telecommunication based consultation in real time between a stroke patient and her neurologist who was at his home more than 25 miles away.

In my own plastic surgery practice, simple everyday use of patient initiated text messaging, Internet, and face-time exchanges have improved patient care and communication dramatically over the past few years. Patients are able to obtain out of pocket cash rates for either cosmetic procedures or reconstructive procedures typically within minutes. We are sometimes able to take insured patients and help them arrive at a real number, out of pocket cost, before moving forward with a consultation.

Government laws regarding self-referral, kickback, and fee splitting

What is and what is not legal in terms of healthcare provider‘s care of patients with specific regard to virtual interactive consultation online. Would a business model that allowed interactive consultation and determination of pricing by negotiation and bidding be a violation of any existing laws which impact the methodology in which patients are referred to providers /specific entities? Are there any antitrust issues, which might need to be addressed? Would the described charges of brokers, financial, and legal services be possible without being considered as fee splitting?

Are there studies that demonstrate the savings and protection to individuals that has occurred as a result of the self-referral laws that are currently in place?

How big would healthcare savings needs to be in order for legislation to be put in place to repeal or soften enforcement of existing laws of self-referral. Is there anything about the proposed business that would be construed as self-referral, or fee splitting?

Would a service that allows interactive / virtual consultation with negotiation and bidding for medical services break existing laws? Who would be qualified to answer that question?

What would be the input from those in favor of or those opposing the proposed changes that might occur with an interactive /virtual online platform for patients seeking healthcare as has been described in this paper?

Bipartisan interest in this business model

In general, it is probably fair to state that the Democratic Party in Washington D.C. strongly supports the Affordability Care Act, being described synonymously with Obamacare. In general, the Republican Party is opposed to the ACA, favoring less government involvement with healthcare. The present political efforts to promote a marketplace for government approved insurance exchanges might benefit from the inclusion of an effort to promote a consumer driven healthcare plan which allows free market forces to determine pricing and value for out of pocket expenses. Republicans might rally in support of a more comprehensive plan to address all healthcare spending. Certainly the Libertarian party would approve.

Liability Medical Malpractice Companies

How would traditional medical malpractice carriers view this type of activity by their insured physicians? i.e. adding a liability rider to each health care service:? My immediate thought is that there would be no coverage for activities outside traditional methods of consultation. However, if having the liability rider on each procedure lowered the overall exposure to the traditional malpractice carriers, or if doctors chose companies that differentiated themselves by allowing virtual consultations and insurance riders, the carriers might morph into something more user friendly to their customers who would in turn pass savings on to patients and providers.

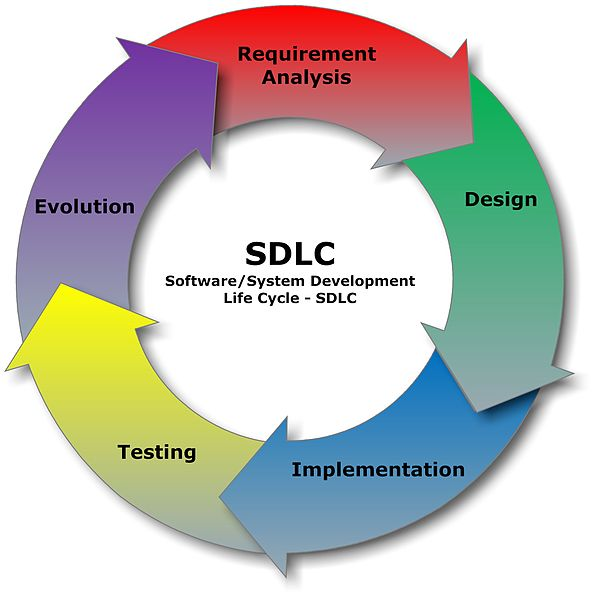

Software Platforms and technology

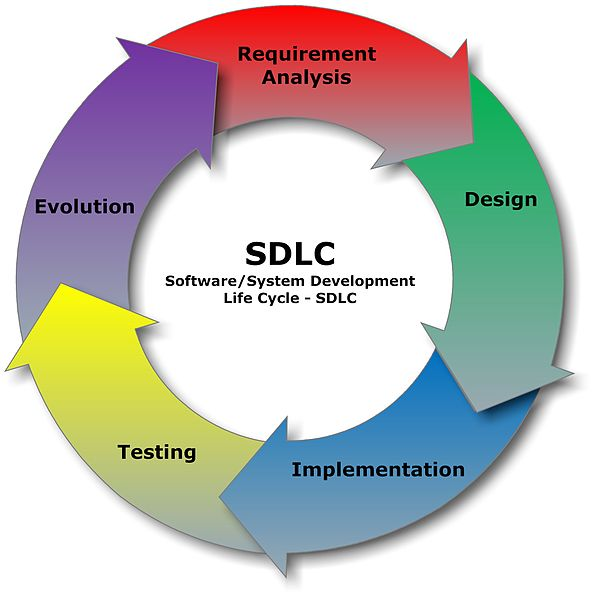

How does one go about building a software platform that can accomplish the following goals, to be described? How is the team organized and financed? How long does it take to create the first prototype? How much does something like this cost?

(Above diagram) Model of the Systems Development Life Cycle - taken from Wikipedia

Can a process be patent protected? Is there any technology described here that could be patent protected?

The government construction of the healthcare.gov website and the Covered California website is estimated to be in the hundreds of millions of dollars. The government plans to hire 10,000 workers and to spend forty-five millions dollars to market the healthcare insurance exchanges. What would it cost in the private sector? Could the private sector share some of the responsibilities of this business with the government?

What would be cost of starting SutureSelfMD on a small scale to test on a single unit. What are the costs of ramping it up to for testing with a larger market?

How are licensing fees determined?

Many components of these systems exist already as seen on successful Internet businesses such as Priceline, Orbitz, Trip Advisor, Pay Pal, eBay, and Facebook, Amazon.

Who can help put the right team together? How can the developers, visionaries, and entrepreneurs from these successful enterprises be used to help or advise in the creation of a new company and build the type of service described here?

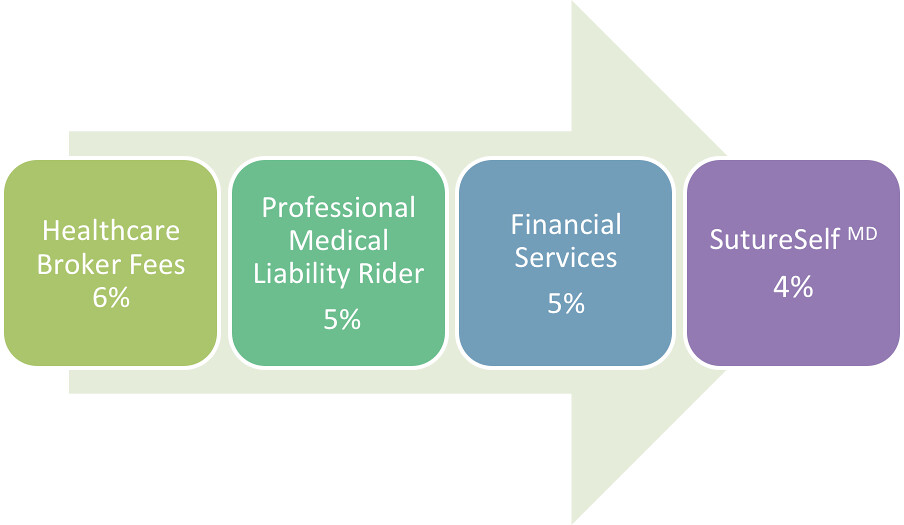

Transactional Fees for SutureSelf MD

In the future, the Affordability Care act has suggested that healthcare insurance carriers will be allowed a maximum of 20% administrative fees that are not dedicated to providing health services. Benchmark against current healthcare insurance industry: Overhead, which includes executive salaries 30%; profit margin 4 to 6% New York Times article September 23, 2013 (comment)

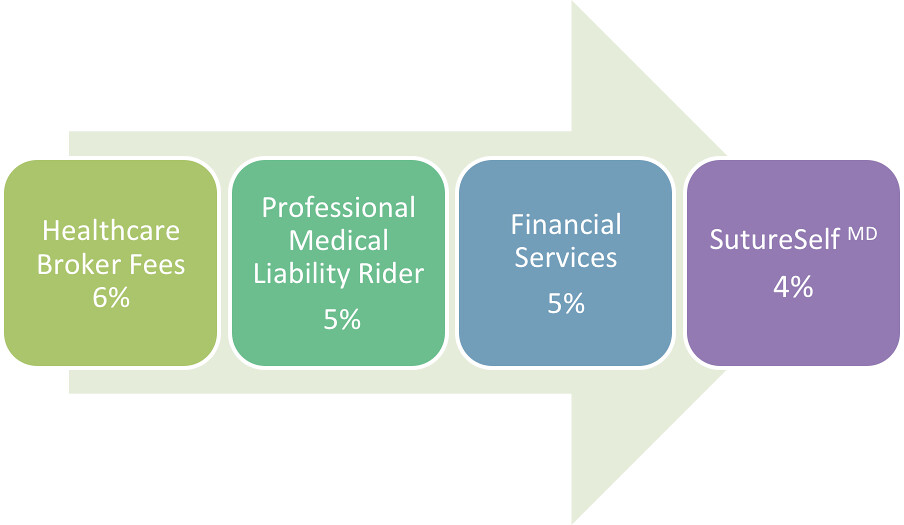

The proposed business model of SutureSelfMD is obviously subject to changes and modifications as it is developed by groups of individuals who can brainstorm, and test the process in the marketplace. It would seem that a 6% brokers fee, a 5 % embedded malpractice rider fee, and a 5% finance fee for short term credit, would still allow up to 4% transaction fees to be returned to company investors; leaving 80% of fees to be directed to the providers of healthcare services.

Figure 3: Transactional Fees estimated at 20% of total cost per service cycle.

Venture Capital and Legal Entities

How does one identify the best sources and methods of raising venture capital for this service? How would the legal services for this new healthcare service be developed? What would be the strengths and weaknesses in moving forward with this system?

If one were to look forward six months or even a year after the venture moves forward into the market place, what specifically would have to take place in terms of dollars and numbers in order for investors to consider this venture successful? 5

Would Kickstarter, or Indiegogo, popular sites for crowd funding be viable options to raise money for this business?

Maybe a contest could be held to bring the best and brightest minds into the challenge of creating this new virtual online healthcare system. 5.5

Financial Services

Over the past few years finance companies have been putting a significant effort into dental and plastic surgery offices attempting to capture the population of individuals who are interested in financing their anticipated elective services. Most notable in our office is Care Credit, which is an arm of GE capital. Currently both the patient and the healthcare provider offer a premium to the finance company in order for the transaction to take place.

It is my contention that finance companies would play a strong role in the value proposition of the service that is being described in this paper. Online payment would occur with credit cards or with loans brokered by finance companies.

Financing charges for services would vary by the financial risk or well being of the client. Estimate 4 % to 5% short term, for individual with good credit.

Can Do - Medical Brokers

Maybe better described as healthcare negotiators, these highly skilled brokers of medical care will work on a commission basis to match the patient to the provider, the buyer to the seller of healthcare.

Can-Do Medical Brokers, named because of their propensity to make something positive happen, will be able to draw on information and a network of resources to provide value in an individual's SutureSelf MD healthcare decision. This will be in contrast to the legion / army of knowledgeable individuals who have worked over the past few decades within the insurance industry solely to determine how to deny benefits.

The broker’s commission will be based on a percent of the overall medical transaction fee. Estimated at 6%, this fee might possibly be shared between buyer and seller agents, similar to that which is seen in the real estate industry. Obviously, this fee will be subject to modifications based on market forces, complexity and value of service. Brokers in this model would probably need to be individuals highly sophisticated and educated regarding the health care process. This group might include nurses, nurse PR actioners, and physicians. Retired physicians or those who do not enter practice might represent an excellent source of brokers who possess the knowledge and clinical insights to guide buyers and sellers of healthcare though the complicated process.

Medical brokers will rely on volume to achieve salaries that would be competitive with earning that could be otherwise be achieved working in a clinical setting

This would be in stark contrast to the skills of “navigators,” who are planning to help individuals shop through government sponsored healthcare exchanges. The latter group of health care guides are proposed to have up to 20 hours of training , be paid $15.00 per hour and pass federal background checks as reported in article by Carla Johnnson, in The Associated Press, on Tuesday, September, 10, 2013.

Anticipated Revenues for New Business

300 Billion Dollars Out of Pocket - “negotiable services / discretionary income”

Capture 10 % of this market – similar to online travel services = 30 Billion Dollars

4% to 5% Revenues - Similar to earnings of health insurance companies = 1.5 Billion Dollars

Profits on these revenues – Estimate 20 % - similar to medical practices = 300 million dollars per year.

(this does not include profits to be derived by brokers, liability policies, or financial services)

The above statements are all assumptions. Are these numbers too high or too low?

I would invite commentary from individuals knowledgeable and / or opinionated on this subject.

Market Research Questions Might Include:

Online and personal survey with prospective users

Discuss the relevance of the plastic surgery industry - spending of discretionary income by consumers.

Local markets vs. travel I would imagine that this system would work better in local markets.

What is most important to doctors, healthcare providers, and clinics that would provide services based on online virtual consultation? I suspect the answer will be to be paid a fair market price for services provided, to fill schedules that are currently open, to minimize risk of diagnoses or treatment errors thereby reducing liability. Doctors would like to be paid in a timely manner. Similar to the retail industry, payment is made when services are rendered. I imagine that incorporating a financial service to provide immediate payment would be an important feature of the proposed business.

Currently physicians in private practice face an onerous process of collecting money from the government and insurance carriers with outstanding accounts receivable sometimes aging 6 months or more before payment is made. The last decade has seen a mass migration of non-specialty trained physicians into cosmetic spa and surgery services. Fees and payments are made upfront before services are rendered. Doctors and healthcare providers, like the rest of the retail community, like to be paid when services are rendered: it is human nature. It is my contention that offering immediate payment will incentivize the willingness of health care providers to participate in virtual consultations..

Healthcare is the only industry in The United States where individuals agree to pay for services not knowing the costs3.

Imagine a customer going to Sears and wheeling a brand new washer dryer out of the store into the parking lot. The store manager says, enjoys, we will figure out the bill later, and after a few months sends you an invoice.

Healthcare providers like anyone else want to feel appreciated. The final circle of the healthcare cycle, Figure 1, is about value feedback. This will be a place where patients can voice their appreciation of a service rendered. This might be a place where healthcare providers can assess patients.

What is most important to individuals seeking healthcare through a virtual consultation?

Possible questions might read: List on a 1 to 5 scale, with 1least and 5 most what is important to you as a patient. Anonymity; privacy issues; quality of service; timeliness of results; cost; financing; access to records; access to the physician or allied healthcare provider (for diagnostic tests such as mammograms or MRI’s). safety, trust.

What else is in inherently important to patients? Thoughts on malpractice:

The ability to sue and seek compensation for errors and complications is deeply embedded in our way of thinking. Whether we accept it or not, we are a society of victims, and the need to seek remedy or relief for perceived wrongdoing is particularly important to many Americans when it comes to healthcare.

From a marketing point of view, what types of ads might appeal to individuals interested in this service? Is the name SutureSelfMD reasonable? Should the name be different i.e. more reflective of the business function. How would this look?

Possible Ad Campaign

Sorting out the costs of your healthcare shouldn’t be so difficult…

SutureSelf MD

Empowering people with “virtual” tools to optimize their healthcare decisions

My “Prescriptive” wish List of the State and Federal Government.

In order for consumer driven healthcare economics to be successful, it would be helpful if the government can offer a little breathing room, i.e. relax legislative oversight of some aspects of healthcare law. An example of the government choosing to put less pressure on existing laws might be the recent stance of the Federal Government not to direct resources against the recreational users of marijuana in Colorado and Washington State.

Variations of the following existing laws and practices that would be helpful:

HIPAA: Allow individuals to protect or share personal health information at their own discretion.

Loosen oversight of Stark, Self-Referral, and Fee Splitting Policies: In many cases, physicians, nurses, and other allied healthcare workers are in an excellent position to understand the economics of medicine. Allow doctors to refer to clinics or facilities in which they are owners; allow patients the freedom to choose clinics where physicians are owners. Free market forces will determine the success or failure of such clinics. User’s feedback and valuation will allow consumers to decide whether or not to choose physician owned clinics.

Allow the practice of “virtual” medicine across State Lines. Allow patients interested in a virtual consultation to seek input from doctors across state line.

Allow the sale of malpractice liability insurance across State Lines.

ACA / Obamacare: Redefine and broaden the scope of what is defined as a legitimate healthcare insurance policy. Allow individuals, or groups, purchasing healthcare insurance of any deductible or coverage benefits to be free of anticipated taxation penalties as currently prescribed by ACA / Obamacare policies for individuals who do not purchase government sponsored approved health insurance.

Encourage Catastrophic Plans: Allow the size of the deductible portion of healthcare insurance to be as high or low, and the coverage of healthcare benefits to be as broad or narrow, as the individual or group chooses. Individuals, families, or businesses that decide to purchase health insurance with high deductibles will be able to do so at a great cost savings that should be transparent. For example, healthy young individuals might choose catastrophic health insurance, defined by this paper, as insurance for medical expenses over $10,000.00, 15,000.00 or even $25,000.00. Individuals will pay less for high deductible health insurance, and as such, have money left to pay for consumer driven healthcare products of their choice. Withdraw plans to impose taxes upon businesses that pay for excellent healthcare policies for their employees.

Simplify the written language that pertains to legislation, finance, insurance, and healthcare. Create translators for healthcare legislation.

Allow tax deductions / and broaden the scope of “hold harmless and good Samaritan acts.” for physicians, allied healthcare workers, and institutions, that offer free care to those in need.

Discussion / Author’s Opinion

SutureSelfMD is about obtaining quality healthcare, not healthcare insurance, reasonably priced.

This new business model is not specifically in conflict with proposed changes noted in the Affordable Care Act, or Obamacare. But rather, it addresses the issue of pricing, and value of health care that represents a sizable portion of health care expenses, i.e. out of pocket expenses, not covered by healthcare insurance.

There is a “sizable gap” between services covered or partially covered by healthcare insurance and 3rd party payers, and actual out of pocket medical expenses incurred by individuals. There is a significant misunderstanding of what health insurance covers when it comes to treating most non-catastrophic ailments and maintenance examinations. An otherwise healthy individual with healthcare insurance still has to pay for much of his or her medical services, including pharmaceuticals. Healthcare insurance, with deductibles, and exclusions, will not cover the most common everyday services encountered by most reasonably healthy individuals.

As a supplement to health insurance; SutureSelfMD - describes a virtual service that allows for individuals to shop within the space of medical services that are most often needed on a daily basis and / or not covered by their healthcare insurance plan.

The plan as described allows competition and profitability to occur in a number of phases of the transaction cycle including a broker’s fee, liability fee, finance fee, and fee to share holders - all with a cumulative well below the 30% fee attributed to the cost of doing business in traditional health insurance companies, and less than or equal to the 20 % cost of operations mandated by Obamacare. Essentially, there are price competitive features within the cycle described, and the traditional insurance carrier has been eliminated.

According to a publication by the online resource WebMD, The Affordable Care Act has three main goals: 1) Help more people have health insurance. 2) Reduce the cost of health care. 3) Improve how people get health care.

SutureSelf MD supports the second and third leg of these goals.

It is for individual who is suffering from a common cold, a sprained ankle, an asthma attack, or one who needs an MRI of the shoulder. It is designed for someone who wants to go online to shop for an expensive pharmaceutical prescription for any number of common ailments, such as eye drops for conjunctivitis, or an inhaler for asthma, or anti-inflammatory medications for arthritis.

SutureSelf MD - A business model has been described that will include transactional fees for medical brokers, financial services, medical malpractice riders which will be attached to each transaction, and limited releases of liability provided by legal services.

Patients will be able to search and negotiate for pricing of services that offer optimal value. Feedback and reporting on the value of services will visible online to consumers.

The fact remains, for a very significant percent of our health care dollar expenditures for the foreseeable future, we need a way to shop for our health just as we might for other retail services.

References / Personal

Communications:

2. Brill,

Steven (2013, February 20). Why medical bills are

killing us. Time.com. http://healthland.time.com/why-medical-bills-are-killing-us/.

http://www.strategiccoach.com/bios/bio_entrepreneur_coach_dan_sullivan.html

11. Hay, Joel (2o13, September 9). Anatomy of

health care billing. OC Register.

To learn more on this subject and develop further insight into the plausibility of this business concept - interviews might be conducted with individuals who posses expertise in the following subjects.

Physicians, healthcare lawyers; lawmakers familiar with the affordable care act /Obamacare, Covered CaliforniaTM; and the Stark Law. Antikick back experts, corporate lawyers,, patent attorneys and intellectual property specialists; Risk actuaries particularly in the healthcare industry. Software programmers and informational technology engineers, particularly those familiar with negotiations and online bidding, those familiar with pricing, supply, demand, and capacity issues; individuals with expertise in insurance, malpractice. Start-up and venture capital experts, finance experts; doctors, nurses, patients, administrators, medical illustrators, and graphic design experts, public relations and communication experts, writers, editors, publishers, social network experts; Members of the California Medical Board.; healthcare journalists, authors, and individuals mentioned in this paper.

All of the above named authors and referenced individuals including: Elizabeth Rosenthal; David Lazarus, Nina Bernstein, Anderson Brill, Bernard J. Wolfson, Peter H. Diamandis, Steven Kotler, Jim Gray, , Dan Sullivan, John Sutherland

Entrepreneurs, founders, CEO’s, technology engineers, and representatives from Priceline, Orbitz, Trip Advisor, Pay Pal, eBay, Facebook, Apple, Oracle, Amazon, and other tech companies.

Experts from GE capital who currently manage Care Credit medical financing.

Health and Human Service Director, Kathleen Sebelius.

Peter Stark - Author of Stark Laws

List to be expanded – more to follow.

About the author

Donald Altman M.D., M.B.A. is board certified in Otolaryngology - Head and Neck Surgery and in Plastic Surgery. He holds an MBA from the Kellogg School of Management, Northwestern University. With a background in plastic surgery, he is very familiar with pricing of medical and surgical services outside the realm and coverage of benefits from health insurance and government allowances, particularly as it applies to discretionary spending of healthcare dollars.

He has enjoyed over 25 years of private practice as a successful plastic surgeon in Irvine, California. He is known for his creativity, sense of humor, and superb communications skills